The annual report shows a consolidated report of gifts from our alumni, students, parents, friends, faculty, staff, corporations, foundations and other organizations received by Norwich University; each report is from June 1 - May 31, of that fiscal year. The report is compiled by the staff of the Development and Alumni Relations Office in consultation with the Chief Financial Officer.

For any questions regarding these reports or for more information on making a gift to Norwich University, see our giving pages, email advancement@norwich.edu or telephone the Development and Alumni Relations Office at (802) 485-2300.

Annual Reports

Tab 1 - Report of Gifts

Note: We include every gift that was made during the fiscal year.

Tab 2 - Statements Of Financial Position And Activities: 2-Year Comparative Summary

Tab 3 - Partridge Society Membership Listing

Tab 4 - Corporations/Foundations that made a FY25 Gift

Tab 5 - Class listings – Total amount given in FY25 & participation rate

-

Report of Gifts

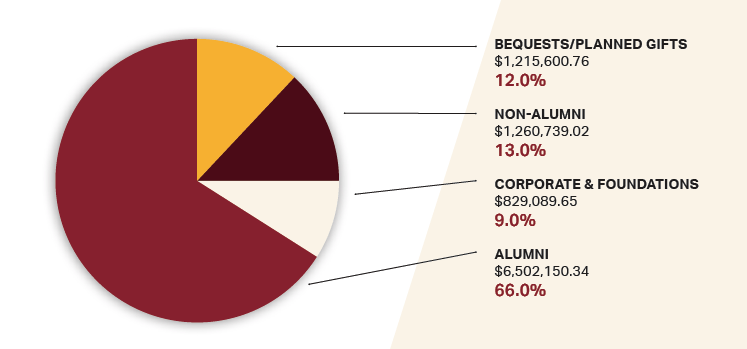

FY25 GIFTS BY SOURCE

GIFTS BY SOURCE TOTAL: $9,807.579.77

Information for FY25 Gifts

Campaign Name Restricted Unrestricted Grand Total Bearing the Torch $681,513.50 $23,467.50 $704,981.00 Forging the Future $572,053.21 $55,459.92 $627,513.13 Fueling the Future $3,812,961.15 $2,541,778.78 $6,354,739.93 Norwich Forever! $27,301.46 $27,301.46 NU Support $1,415,280.55 - $1,415,280.55 Shoulder to Shoulder $450,537.42 $227,226.28 $677,763.70 Grand Total $6,932,345.83 $2,875,233.94 $9,807,579.77 -

Financial Position And Activities

STATEMENTS OF FINANCIAL POSITION: 2-YEAR COMPARATIVE SUMMARY (IN THOUSANDS)*

ASSETS

2025

2024

Cash and Cash Equivalents $28,899 $30,920 Pledges, Accounts, and Loans Receivable, Net $17,323 $21.609 Investments $293,333 $280,542 Land, Buildings, and Equipment $163,623 $164,759 Other Assets $23,267 $19,779 TOTAL ASSETS $526,445 $517,609 LIABILITIES

2025

2024

Accounts Payable and Accrued Expenses $11,075 $10,764 Bonds Payable $61,685 $65,046 Other Liabilities $14,507 $15,123 TOTAL LIABILITIES $87,267 $90,933 STATEMENTS OF ACTIVITIES: 2-YEAR COMPARATIVE SUMMARY (IN THOUSANDS)*

OPERATING ACTIVITIES

2025

2024

Other Income $3,726 $4,294 Tuition Fees, Room and Board, and Other Ed. Programs $74,852 $72,763 Non-Education and Auxiliary Programs $1,333 $1,271 Contributions and Grants Used in Operations $32,384 $33,582 Endowment Spending and Investment Income $20,051 $25,325 TOTAL OPERATING REVENUES AND SUPPORT

$132,346

$137,235

Operating Expenses $128,350 $127,589 Change in Net Assets from Operating Activities $3,996 $9,646 NON-OPERATING ACTIVITIES 2025 2024 Endowment Investments Return Net of Spending Used to Support Operation $8,217 $14,294 Other Non-Operating Activities $286 $10,315 TOTAL CHANGE IN NET ASSETS FROM NON-OPERATING ACTIVITIES

$8,503

$27,743

TOTAL CHANGE IN NET ASSETS

$12,499

$34,389

*Represents non-audited results

-

Partridge Society Membership Listing

The Annual Partridge Society Membership Listing acknowledges and celebrates gifts received and Partridge Society memberships granted during the fiscal year which spanned from June 1, 2024 to May 31, 2025.

The mission of the Norwich University Partridge Society is to aid the Norwich University Development and Alumni Relations Office in the creation and execution of plans and tactics in support of the University’s fundraising priorities; to help secure the University’s financial future through exceptional relationships and to formally recognize and celebrate university donors.

-

Corporations/ Foundations - FY25 Gifts

Ameriprise Financial

Boeing Company

Bristol-Myers Squibb Foundation

Caterpillar Foundation

Charter Oak Credit Union

Chevron

Cigna Foundation

Citizens Private Bank

Consigli Construction Company, Inc.

Dalton Enterprises, Inc.

Dell Technologies

Deloitte Foundation

Delta Air Lines Foundation

Deutsche Bank AG

E.F. Wall & Associates, Inc.

Eversource Energy

General Electric Company

George & Carol Olmsted Foundation

Global Guardian

Google

Grout Enterprises, LTD

Haynes Family Foundation

Home Depot

Howden RE (TigerRisk)

J. Petrocelli Contracting, Inc.

Jack & Dorothy Byrne Foundation, Inc.

Jephson Educational Trusts

John P. Stabile Family Foundation

Johnson & Johnson

Legion Thirteen

Lockheed Martin Corporation

Mack Foundation

Massachusetts Mutual Life Insurance Company

May Ellen & Gerald Ritter Foundation

Microsoft Corporation

New York Life Insurance

NFP Property & Casualty Services, Inc.

Philip Snyder Foundation

Phoenix Holdings Partnership

Pritzker Military Foundation

PSEG Public Service Electric & Gas Company

Raytheon Company

Roy A. Hunt Foundation

Sean J. Moran Memorial Fund

Shepherd Nichols Family Foundation

Simmons Family Foundation

SL Green Management, LLC

Stamford Hospital Foundation

State Farm Insurance Companies

TD Charitable Foundation

Textron, Inc.

The George F. & Sybil H. Fuller Foundation

U.S. Charitable Gift Trust

United Health Group

United States Automobile Association

Vanguard Plastics Corporation

Verizon Communications, Inc.

Vertex Pharmaceuticals, Inc.

Wells Fargo Foundation

Williston Golf Club, Inc.

-

Class listings – Total amount given in FY25 & participation rate

Class Year

Gifts Received FY 2025

Participation Rate FY 2025

Class of 1949 65,000 0.98% Class of 1951 6,000 0.09% Class of 1952 8,170.4 0.12% Class of 1953 5,000 0.08% Class of 1954 371,500 5.63% Class of 1955 4,569.2 0.07% Class of 1956 4,116 0.06% Class of 1957 75,199.57 1.14% Class of 1958 101,662.5 1.54% Class of 1959 347,532.2 5.26% Class of 1960 276,411.07 4.19% Class of 1961 45,185.78 0.68% Class of 1962 23,190.61 0.35% Class of 1963 54,270.8 0.82% Class of 1964 162,497.72 2.46% Class of 1965 200,817.82 3.04% Class of 1966 140,318.37 2.12% Class of 1967 132,625.92 2.01% Class of 1968 161,672.65 2.45% Class of 1969 416,085.46 6.30% Class of 1970 207,687.81 3.14% Class of 1971 287,970.39 4.36% Class of 1972 75,704.24 1.15% Class of 1973 109,647.77 1.66% Class of 1974 169,672.61 2.57% Class of 1975 128,036.26 1.94% Class of 1976 60,428.35 0.92% Class of 1977 62,449.4 0.95% Class of 1978 23,199.57 0.35% Class of 1979 98,704 1.49% Class of 1980 333,995.92 5.06% Class of 1981 83,301.2 1.26% Class of 1982 57,240.68 0.87% Class of 1983 HIGHEST GIFT TOTAL & PARTICIPATION RATE FOR FY2025 Class of 1983 585,515.53 8.87% Class of 1984 515,847.2 7.81% Class of 1985 92,940.03 1.41% Class of 1986 106,149.49 1.61% Class of 1987 82,299.94 1.25% Class of 1988 149,017.38 2.26% Class of 1989 31,117.13 0.47% Class of 1990 159,351.66 2.41% Class of 1991 22,845.97 0.35% Class of 1992 44,925.8 0.68% Class of 1993 48,866.18 0.74% Class of 1994 53,907.87 0.82% Class of 1995 16,810.32 0.25% Class of 1996 55,931.6 0.85% Class of 1997 28,440.44 0.43% Class of 1998 7,228.24 0.11% Class of 1999 27,951.04 0.42% Class of 2000 18,280.6 0.28% Class of 2001 14,844.04 0.22% Class of 2002 8,571.8 0.13% Class of 2003 8,748.08 0.13% Class of 2004 5,936.44 0.09% Class of 2005 12,803.72 0.19% Class of 2006 108,280.5 1.64% Class of 2007 10,783.65 0.16% Class of 2008 2,407.2 0.04% Class of 2009 2,826.9 0.04% Class of 2010 6,291.84 0.10% Class of 2011 6,582.11 0.10% Class of 2012 5,223.16 0.08% Class of 2013 11,459.65 0.17% Class of 2014 10,163.05 0.15% Class of 2015 2,799.44 0.04% Class of 2016 5,335.9 0.08% Class of 2017 3,890.16 0.06% Class of 2018 11,473.56 0.17% Class of 2019 6,385.31 0.10% Class of 2020 2,776.2 0.04% Class of 2021 2,738.52 0.04% Class of 2022 2,914.33 0.04% Class of 2023 2,196.12 0.03% Class of 2024 1,063.34 0.02%

Tab 1 - Report of Gifts

Note: We include every gift that was made during the fiscal year.

Tab 2 - Statements Of Financial Position And Activities: 2-Year Comparative Summary

-

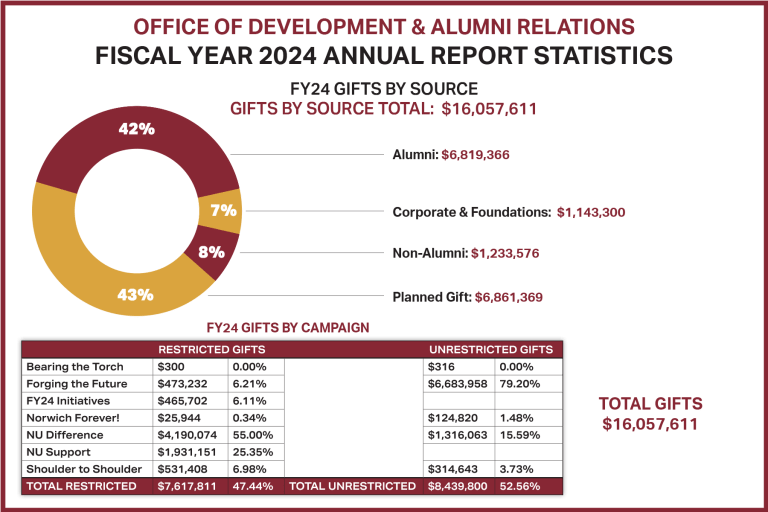

FY24 Gifts

-

Financial Position And Activities

Statements Of Financial Position: 2-Year Comparative Summary

2024 2023 ASSETS Cash & Cash Equivilants $30,920 $20,544 Pledges, Accounts & Loans Receivable, Net $20,983 $17,504 Investment $280,542 $262,930 Land, Buildings, and Equipment, Net $164,759 $167,946 Bond Funds on Deposit with Trustee $0 $0 Other Assets $20,405 $18,885 TOTAL ASSETS $517,609 $487,809 LIABILITIES Accounts Payable and Accrued Liabilities $10,764 $8,452 Bonds Payable $65,046 $68,432 Other Liablities $15,123 $18,638 TOTAL LIBILITIES $90,933 $95,522 Statements Of Activities: 2-Year Comparative Summary (In Thousands)

Operating Activities Other Income $4,294 $2,933 Tuition Fees, Room & Board, & other Education Programs $72,763 $73,779 Non Education & Auxiliary Progams $1,271 $1,151 Contributions & Grants Used in Operations $33,582 $22,975 Endowment Spending & Investment Income $25,325 $22,165 Total Operating Revenues & Support $137,235 $123,003 Operating Expenses $127,589 $122,071 Change in Net Assets from Operating Activities $9,646 $932 Non-Operating Activities Endowment Investments Return Net of Spending Used To Support Operations $14,428 ($26,534) Other Non-Operating Activies $10,315 $4,837 TOTAL CHANGE IN NET ASSETS FROM NON-OPERATING ACTIVITIES $24,743 ($21,697) TOTAL CHANGE IN NET ASSETS $34,389 ($20,765)

Tab 1 - Report of Gifts

Note: We include every gift that was made during the fiscal year.

Tab 2 - Statements Of Financial Position And Activities: 2-Year Comparative Summary

-

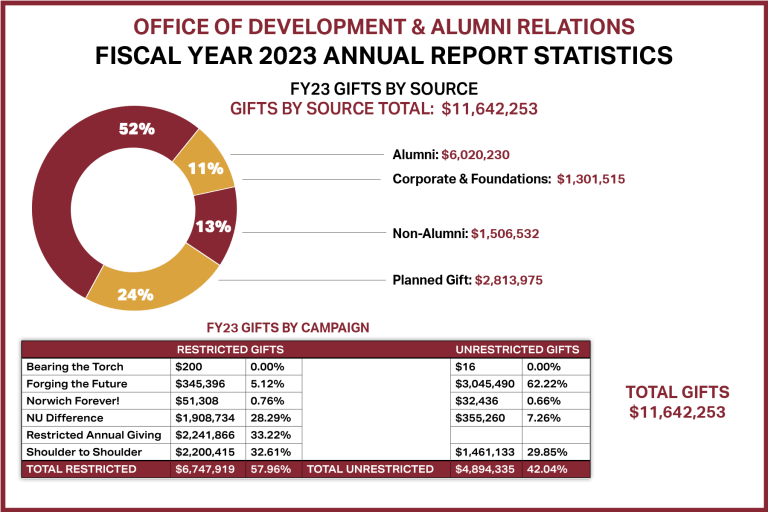

FY23 Gifts

-

Financial Position And Activities

Statements Of Financial Position: 2-Year Comparative Summary

2023 2022 ASSETS Cash & Cash Equivilants $20,544 $20,182 Pledges, Accounts & Loans Receivable, Net $17,504 $19,538 Investment $262,930 $283,445 Land, Buildings, and Equipment, Net $167,946 $169,495 Bond Funds on Deposit with Trustee $0 $0 Other Assets $18,885 $20,205 TOTAL ASSETS $487,809 $512,865 LIABILITIES Accounts Payable and Accrued Liabilities $8,452 $9,958 Bonds Payable $68,432 $71,556 Other Liablities $18,638 $18,298 TOTAL LIBILITIES $95,522 $99,812 Statements Of Activities: 2-Year Comparative Summary (In Thousands)

Operating Activities Other Income $2,933 $2,529 Tuition Fees, Room & Board, & other Education Programs $73,779 $79,137 Non Education & Auxiliary Progams $1,151 $904 Contributions & Grants Used in Operations $22,975 $25,026 Endowment Spending & Investment Income $22,165 $11,210 Total Operating Revenues & Support $123,003 $118,806 Operating Expenses $122,071 $119,264 Change in Net Assets from Operating Activities $932 ($458) Non-Operating Activities Endowment Investments Return Net of Spending Used To Support Operations ($26,534) ($48,739) Other Non-Operating Activies $4,837 $5,411 TOTAL CHANGE IN NET ASSETS FROM NON-OPERATING ACTIVITIES ($21,697) ($43,328) TOTAL CHANGE IN NET ASSETS ($20,765) ($43,786)