What Does Norwich Forever Mean to You?

You can honor your meaningful experience and memories on the Hill with a gift that lives through time. Planned gifts take many forms, but each one lets you prioritize Norwich in advance.

Planned giving pays it forward but can also benefit you in the here and now. Gifts through your estate, gifts that pay you income, and other types of planned gifts support Norwich while delivering financial and tax benefits to you and your family.

Planned Giving Impact

What Will Your Legacy Be?

What lives on in your memories of the Hill? Let that moment of personal significance guide your gift. Explore ideas. Be creative. You can find inspiration in the gifts of other donors. We look forward to helping you write the next chapter of your Norwich story. When you’re ready...

contact our team for more information.

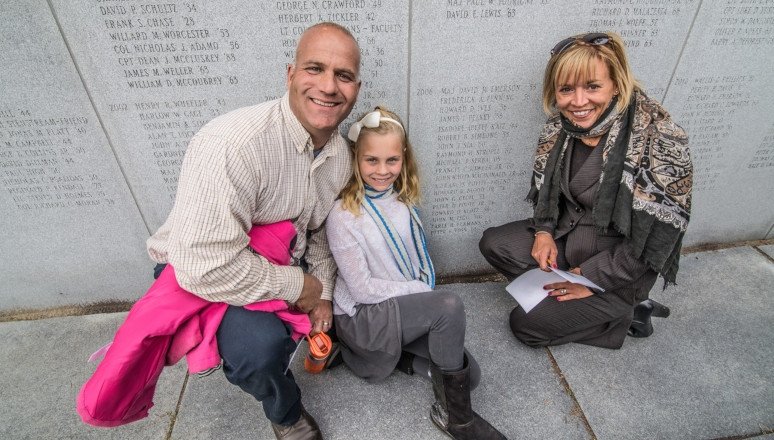

Read About Why our Alumni Love to Give Back

Plan Your Legacy

Are you ready to plan your will or trust? We would like to give you a FREE Estate Planning Guide. This helpful information may enable you to successfully plan your estate and avoid an accidental disinheritance. Then plan to use our Estate Planning Guide to record your family information and your estate distribution plans.

Please enter your name and email address on the form linked to below. Provide for and protect your family with this free Estate Planning Guide.

Plan Your Legacy Through a Free Estate Planning GuideWhat You Can Give

Gifts of Cash

A gift of cash is a simple and easy way for you to make a gift. You will receive a charitable tax deduction that will provide you with savings on this year's tax return.

Gifts of Stocks and Bonds

By making a gift of your appreciated securities, you can avoid paying capital gains tax that would otherwise be due if you sold these assets.

Gifts of Retirement Assets

A gift of your retirement assets, such as a gift from your IRA, 401k, 403b, pension or other tax deferred plan, is an excellent way to make a gift.

Gifts of Insurance

If your life insurance policy is no longer needed or will no longer benefit your survivors consider making a gift and help further the Norwich mission.

Gifts of Real Estate

If you own appreciated real property, you can avoid paying capital gains tax by making a gift to Norwich.